- Keep Cool

- Posts

- Biodiversity: An economic and innovation-focused imperative

Biodiversity: An economic and innovation-focused imperative

Last month, the EU passed a landmark nature restoration law. The EU describes it as "the first continent-wide, comprehensive law" focused on safeguarding and increasing biodiversity. Specifically, it targets restoring 20%+ of degraded ecosystems by 2030 via binding targets across seven fields of action, including peatlands, pollinators, farmland, etc.

In the past, I introduced why biodiversity matters beyond its aesthetic appeal. If you'd like to explore that, this is the primer.

A question I often ask myself regarding any news story or fundraising announcement is, "Why am I reading this now?"

When discussing biodiversity, it's essential to separate the idea that lawmakers care about biodiversity for 'feel good' reasons from the fact that they care about it for economic reasons. Biodiversity has given us world-changing products:

Penicillin: Penicillin, derived from Penicillium fungi, revolutionized medicine by effectively treating bacterial infections.

Aspirin: Aspirin, my friend earlioer this week as I was laid up with a fever, is derived from salicylic acid, which comes from the bark of willow trees.

Quinine: Extracted from the bark of the cinchona tree, quinine has been essential for treating malaria for centuries.

Taxol: Taxol is a chemotherapy drug derived from the bark of the Pacific yew tree.

Vinblastine and Vincristine: Two more chemotherapy drugs used to treat leukemia and other cancers derived from the Madagascar periwinkle.

The pacific yew tree, the progenitor of Taxol (Shutterstock)

Of course, biodiversity also includes more 'basic' (but no less critical) organisms like trees and plants that, you know, give us oxygen to breathe.

And lest it seems like biodiversity is primarily helpful in discovering new medical applications, let's dispel that notion. Today, Newlight Technologies announced a $125M equity raise for its carbon removal and transformation business. The company uses a microorganism it originally found in waters off the coast of California that transforms CO2 and methane into a usable biomaterial. I'll write more about that this Sunday. For now, suffice to say that that's a multi-solve climate tech business predicated on the capabilities of one specific organism.

All of this is to say that protecting biodiversity is an economic and innovation-focused imperative as much as it's a 'nice to have.'

Of course, another reason we are hearing about this now is that biodiversity is declining sharply worldwide, largely due to climate change and land use for things like agriculture. Here's more context from a BloombergNEF report on biodiversity finance:

…biodiversity is shrinking faster than at any point in human history. If we continue the current trajectory, 30-50% of all species may be lost by mid-century. Five direct drivers have caused over 90% of nature loss in the last 50 years (in order of impact): land and sea-use change, climate change, natural resource use and exploitation, pollution and invasive alien species.

Turning around an oil tanker

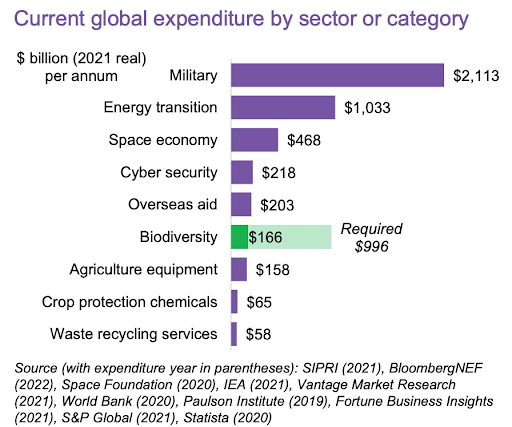

Given this setup, the next logical question is why policymakers and finance have taken so long to recognize biodiversity as a key priority. Safeguarding biodiversity receives about ~1/3rd as much funding as the space economy does:

I have a lot of initial hypotheses here that come to mind as to why this isn’t a bigger investment area.

For one, as essential as it is to all life on earth, biodiversity is difficult to monetize in our existing economic system. While there’s a fledgling voluntary carbon market that I’ve written about extensively that’s making it easier to finance projects that reduce or remove CO2 emissions, the market for biodiversity credits is even smaller and more nascent.

Earlier this year, Swedish banks bought some of the first biodiversity credits, generated by a forest cooperative in central Sweden. These credits are to biodiversity what carbon credits are to CO2; they offer a mechanism for one party to pay another to protect and enhance biodiversity via a specific project.

Attention and focus in and of themselves have also been missing from the biodiversity conversation previously. I often quip that climate tech, even in its current, more evolved cycle, is still myopically focused on carbon.

Further on the financing front, there’s a chicken-and-egg problem that extends from venture-scale financing to growth-scale and investment banking.

Anytime there’s a new ‘sector,’ the initial lacuna of venture funds that focus explicitly on it as well as the absence of examples of successful companies that investors and policymakers can hold up to outline the opportunity, makes it harder for it to grow. In the same way law is often based on precedent, so are investing and bankability; investors look for comparative examples of past success when underwriting investments.

It takes a lot to spark a new investment area from ground zero. Much as oil tankers themselves are significant contributors to biodiversity loss, trying to shift biodiversity loss and investor willingness to fund projects focused explicitly on biodiversity may well be like trying to turn an oil tanker around.

Another factor here is the unfortunate, inherent misalignment between economic growth and protecting biodiversity in many cases. Especially in the developing world, tapping natural resources, whether oil extraction in the Congo or forestry in Papua New Guinea, is a primary lever for economic growth.

Absent support from developed countries, it’s a hard bargain to ask developing countries to forgo growth to protect biodiversity. Again, from the BloombergNEF report we cited earlier:

Much of the world faces a very high level of threat to biodiversity, as nations are unlikely to sacrifice economic activity in nature-exposed industries without support.

My main takeaway is that global progress on biodiversity will need to come from the top down. I.e., from national and international governments. This is probably much more true concerning biodiversity than in many other areas of climate tech, decarbonization, and sustainability. Of the $166M in annual biodiversity funding charted above, the vast majority comes from the public sector as is.

All of this also leads us back to the EU law we opened with. Because it offers a ray of hope. The EU’s law will ideally prove vital beyond its borders. Often, one law in one jurisdiction can catalyze similar laws elsewhere.

Ideally, the EU law will set a precedent that other countries and organizations can copy to make biodiversity protections a priority in their jurisdictions. We saw this play out earlier this year as both California and the EU pushed in parallel to mandate a phase-out of new internal combustion engine sales by 2035.

The net-net

Here’s a striking quote from The Overstory by Richard Powers I read recently:

These people need dreams of technological breakthrough. Some new way to pulp poplar into paper while burning slightly fewer hydrocarbons. Some genetically altered cash crop that will build better houses and lift the world’s poor from misery. The home repair they want is just a slightly less wasteful demolition.

In many ways, I can see how this newsletter sometimes caters too much to Powers’ description of ‘These people’ in the quote above.

Climate tech is great. But it will fall short of its goals if it doesn’t prioritize leveraging and protecting natural systems and the wealth of the world’s biodiversity as much as possible.

It’s worth remembering that many of the greatest ‘inventions’ have been around for millions of years. And that if we’re not careful (and if we don’t scale efforts to make drastic change), half of that ‘tech’ won’t survive to see 2050. Nor will we even know what we lost before we could even discover it.

Reply